Climate Change Risk Assessment and the EP4

By Celetia Sahadave, WKC Group

What is a Climate Change Risk Assessment (CCRA)?

CCRA’s seek to identify the likelihood of future climate risks and their potential impacts, with the aim of prioritisation of appropriate climate action and adaptation. In terms of a new project or development, climate change risk assessments can include both Physical and Transitional Risks.

Physical Risks relate to the physical impacts of climate change, for example:

Direct damage to assets, as a result of extreme weather events (e.g., droughts, storms) or rising sea levels.

Changes in water availability, sourcing, and quality, often with consequent social impacts.

Disruption to operations, ability to transport goods and supplies, and impacts on employee/community safety.

Indirect impacts from supply chain disruption, workforce/community exposure to vector borne diseases (resulting from temperature/precipitation changes), or large movements of people in response to physical impacts of climate change (e.g., sea level rise, desertification, salinization of agricultural land, droughts, storms).

Transitional Risks are those that are caused by not responding to climate change and progressing the way businesses run, and include future changes in climate and energy policies, a shift to low-carbon technologies and liability issues.

Transitional Risks include:

Policy and legal risks – Impact of policy and regulatory actions that seek to constrain the adverse effects of climate change or promote adaptation or transition (e.g., carbon pricing, emissions caps, differential capital treatment by regulators, land use changes, water restrictions).

Technology risks – Technological improvements that support the transition to a lower emissions economy and lead to demand shifts and market advantage for operators who adapt faster (e.g., battery storage, electric vehicles, carbon capture and storage and technologies that enable improved operating efficiency, reduce GHG emissions and optimise water and land use).

Market risks – Shifts in supply and demand for certain commodities, products and services as climate-related risks and opportunities are acted on (e.g., rise in electric vehicle demand, increased production costs due to changing input prices of energy, water, etc.).

Reputation risks – Changing customer or community perceptions of an organisation’s positive or negative impact on the transition to a lower emissions economy (e.g., public perception of coal-fired power).

How do Physical and Transitional Risks Impact Financing Parties and Project Owners?

In terms of the financing parties related to these projects or assets, climate change represents both a reputational risk to the lenders, and a risk with regards to the repayment of the loan. Regarding the Project owner, climate change represents a risk to their assets, operations, and future business viability. The absence of a climate change risk assessment as part of an Environmental and Social Impact Assessment (ESIA), also represents a risk to the environmental permitting / approvals and financing process, which ultimately determines whether a new project or development can proceed or not.

What are the Equator Principles (EP4)?

The Equator Principles were created in 2003 to be used as a global risk management framework providing a common baseline and framework for financial institutions to identify, assess and manage environmental and social risks when financing projects. The Equator Principles have, however, expanded and developed over the years with the release of updated versions. The latest update (EP4) was released in November 2019 and came into effect in October 2020.

Key updates to the EP4 includes the requirement for CCRA and reporting obligations aligned with Task Force on Climate-related Financial Disclosures (TCFD).

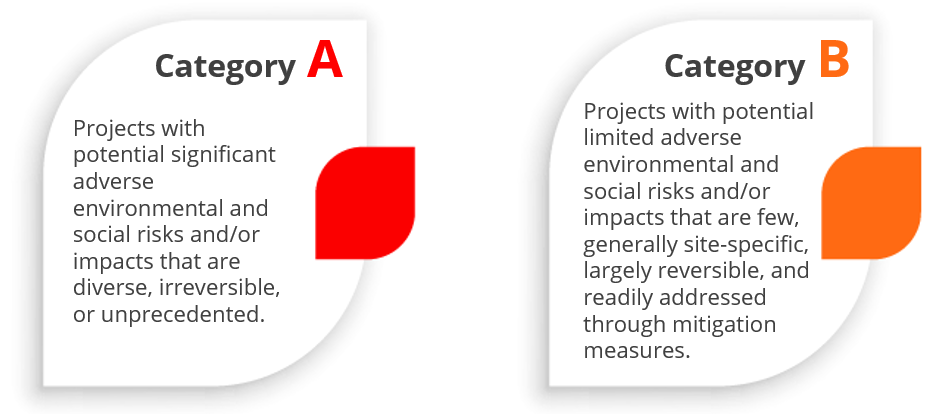

The CCRA applies to Projects with varying obligations depending on the Project’s anticipated greenhouse gas (GHG) emissions. Projects are categorised as follows:

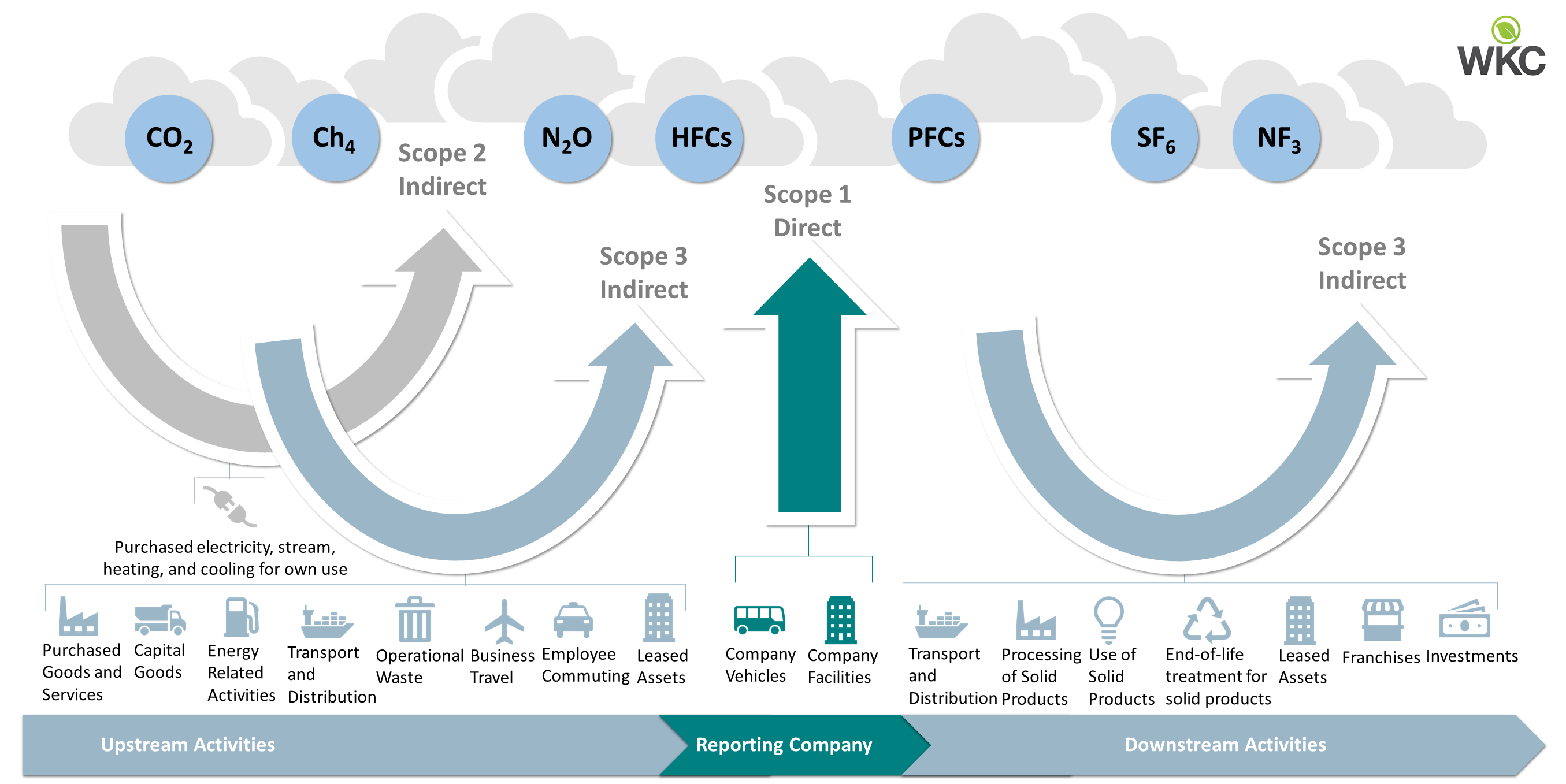

It is interesting to note that for all projects, when combined Scope 1 and Scope 2 GHG emissions are expected to be more than 100,000 tonnes of CO2 equivalent annually, a CCRA is required. The risk assessment is to include consideration of climate-related ‘Transition Risks’ and must also include a completed alternatives analysis which evaluates lower GHG intensive alternatives.

What is Scope 1, Scope 2, and Scope 3 GHG Emissions and What are the Differences Between Them?

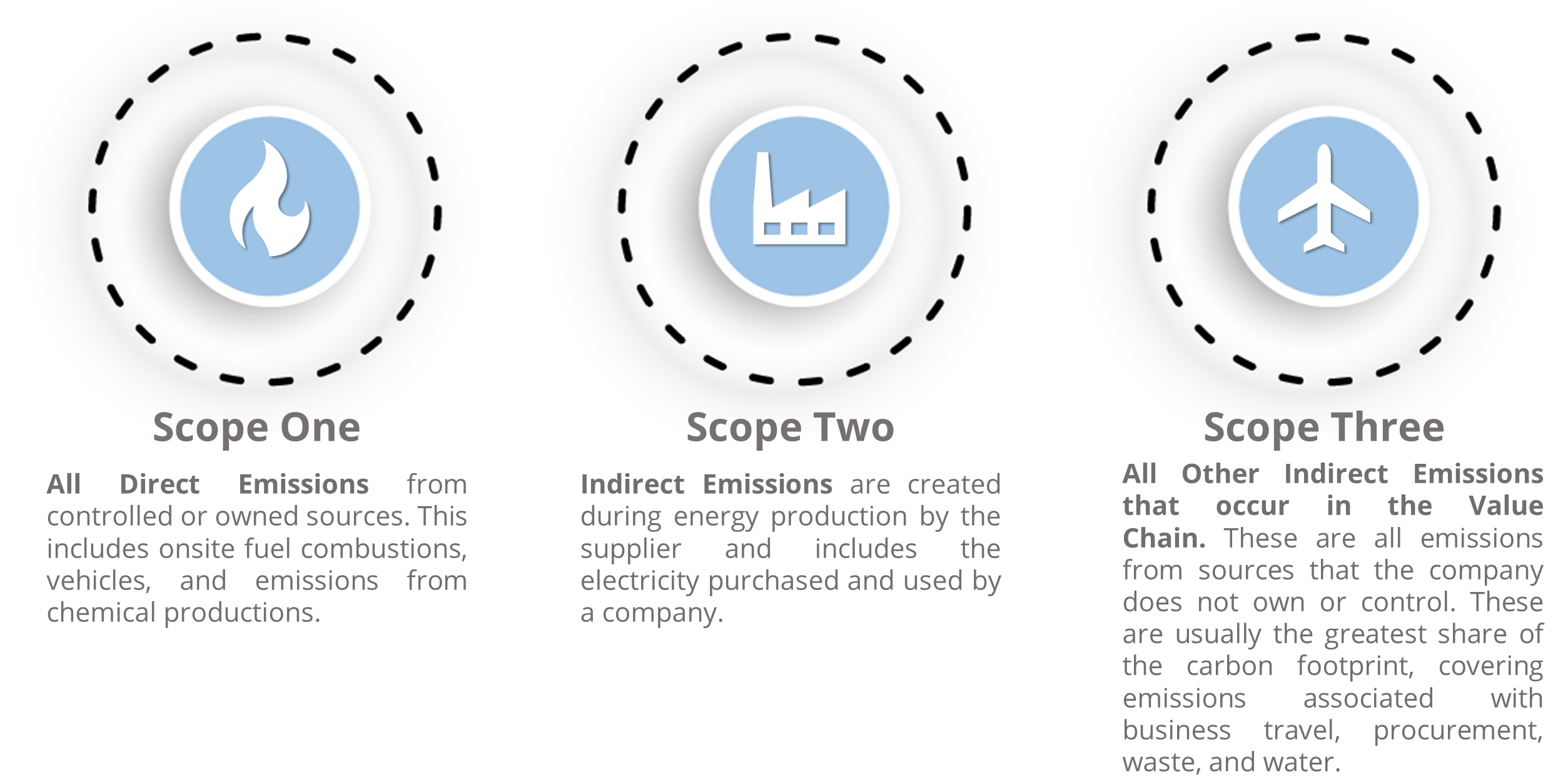

The Greenhouse Gas Protocol (GHGP) has broken down emissions into three categories in order to better understand the source of the emissions. These categories are called Scope 1, Scope 2, and Scope 3. The different scopes act as a global, standardised framework to measure and manage emissions from the operations conducted in private and public sectors, cities, policies, products, and value chains as well as aiding in the prevention of “double-counting” of emissions. Scope 1, Scope 2, and Scope 3 are categorised as follows:

Scope One, Two, and Three GHG Emissions Explained

Click on the infographic to view in full size

In summary, new development projects are increasingly subject to significant scrutiny by Equator Principle Financial Institutions (EPFIs) and their advisors, governmental regulators, Non-Governmental Organisations (NGOs), and shareholders. Therefore, it is imperative to be compliant with the guidelines stipulated in the Equator Principles and to have a CCRA conducted in the early development stages of projects seeking lender finance – to ensure the early identification of future climate hazards and the potential impacts on surrounding cities and communities.

Contact WKC’s team of consultants for more information on Climate Change Risk Assessments.